Triple Bank Collapse hits Silicon Valley & NY amid Economic Downturn

Biggest bank collapse since 2008 triggers new emergency finance moves

Silicon Valley Bank (SVB) collapsed on Friday, March 10, after a wave of bad news rattled investors and depositors. While SVB was not “systemically important” to the U.S. economy, it was roughly the 16th-largest bank in America, by deposits, and was at the heart of the region’s tech industry, bankrolling much of the sector. The Depression-era bank guarantor known as the Federal Deposit Insurance Corporation (FDIC) protects all deposits below $250,000 in regulated American banks, but many Silicon Valley Internet startups had deposited huge amounts of cash from funding rounds with the bank. Federal regulators stepped in to sort out the accounts. Bloomberg reported more than 90% of the deposits (now managed by government caretakers inside the new Deposit Insurance National Bank of Santa Clara) are above the FDIC guaranteed limit.

Unicorn Riot received word Friday of vendors warning payments should not be submitted to SVB-based accounts — showing that impacts to everyday Internet business could be fast and widespread. We also learned it is believed that a 6:30 a.m. Eastern announcement on Monday will specify how the bank will be resolved. Also we heard JPMorgan has been ruled out as the main purchaser of the bank’s assets. On Sunday, March 12, U.S. authorities announced that depositors would be made ‘whole’ on Monday.

This report covers the recent bank collapse, the Covid bailout, the 2007-08 ‘Great Financial Crisis’ and some other sketchy recent economic trends.

Longtime critics of Wall Street self-dealing and inadequate transparency, the Martens at WallStreetonParade.com, noted, “be sure to write down March 9, 2023 as the day that a full-blown bank run began at non-traditional banks in the U.S.”

First the federally insured Silvergate Bank, a hub in the cryptocurrency world, started shutting down on Wednesday, March 8 followed by SVB on Friday morning. (Silvergate was entwined with the fraudulent businesses run by Sam Bankman-Fried, FTX and Alameda Research, more on that below.)

Events are moving fast. Late on Sunday news broke, another troubled bank, First Republic Bank was shored up by JP Morgan Chase. Then problems spread to New York: Signature Bank, another heavily crypto-linked bank, was shut down by state regulators, making three closures in less than a week.

Gloom and doom swept the online chattersphere by Friday afternoon and it became apparent that many business functions of Internet companies are suddenly in peril, most urgently company payrolls that were processed through SVB accounts. Other banks like PacWestBankcorp and First Republic Bank also took huge tumbles on the stock market this week, as did the country’s major banks; not surprisingly, cryptocurrencies are tumbling as many wonder about which crypto firms are exposed to the problem.

Hello Again, Mortgage-Backed Securities

The Federal Reserve Board just dropped a new bailout program late on Sunday:

A “new Bank Term Funding Program (BTFP), offering loans of up to one year in length to banks, savings associations, credit unions, and other eligible depository institutions pledging U.S. Treasuries, agency debt and mortgage-backed securities, and other qualifying assets as collateral. These assets will be valued at par. The BTFP will be an additional source of liquidity against high-quality securities, eliminating an institution’s need to quickly sell those securities in times of stress.

With approval of the Treasury Secretary, the Department of the Treasury will make available up to $25 billion from the Exchange Stabilization Fund as a backstop for the BTFP.”

“Federal Reserve Board announces it will make available additional funding to eligible depository institutions to help assure banks have the ability to meet the needs of all their depositors,” March 12, 2023, 6:15 p.m. (Term Sheet PDF)

Early word is SVB’s bank collapse, by dollar amount the second-largest ever in the United States, was linked to a familiar debt class: mortgage-backed securities (MBS). The new BFTP bailout system will let the Fed ‘purchase’ MBS from banks at the ‘par’ price, which is likely higher than the current bond market price.

Larry Summers, former president Bill Clinton’s Treasury Secretary during the 1990s deregulation wave, called for depositors to be fully covered, beyond the FDIC limit, as investors are heavily concentrated in this bank; David Sacks, an increasingly visible ‘Paypal Mafia’ member and friend to Peter Thiel and Elon Musk, pivoted from his hardline beliefs in merciless free-market capitalism to quickly insist on a full bailout for the bank’s tech depositors. Jason Calcanis, another friend of Musk, previously criticized bailouts but swiftly demanded one for the bank depositors lest panicky doom sweep the U.S. economy.

U.S. Rep. Adam Schiff (D-CA30) also called for covering all the bank’s depositors — he is currently aiming to take outgoing U.S. Senator Dianne Feinstein’s seat and would obviously benefit from the VC tech industry’s support.

Silicon Valley finances were more predicated than widely known on the low interest rates set by the Federal Reserve Board of Governors during the ongoing Covid pandemic. SVB had sought better profits (debt yields) by purchasing MBS during the low-interest interval with depositors money — not an uncommon practice.

The debt markets shifted in recent months. The value of SVB’s MBS fell because higher interest rates made the safer U.S. Treasuries, which are guaranteed by the government, more valuable. SVB’s stock had fallen during 2022 but rallied early in 2023, causing CNBC anchor Jim Cramer to praise SVB as a big investing opportunity just weeks ago; he also praised Signature 11 months ago. Anyone who listened to Cramer’s recent advice, however, would find their stock essentially worthless today.

In its last days, SVB tried to boost its balance sheet by diluting its shares, exercising a plan to create and sell more of them, but this was a last-ditch tactic which destroyed any remaining confidence in the bank’s future.

It is highly likely that SVB will rapidly be broken into constituent parts and sold off by the government to the major American banks, who might be attracted to getting a much larger share of the tech sector’s finances. If a major bank or banks buy into parts of SVB, the depositors would almost certainly be made whole in the end (as the government appeared to confirm late on Sunday).

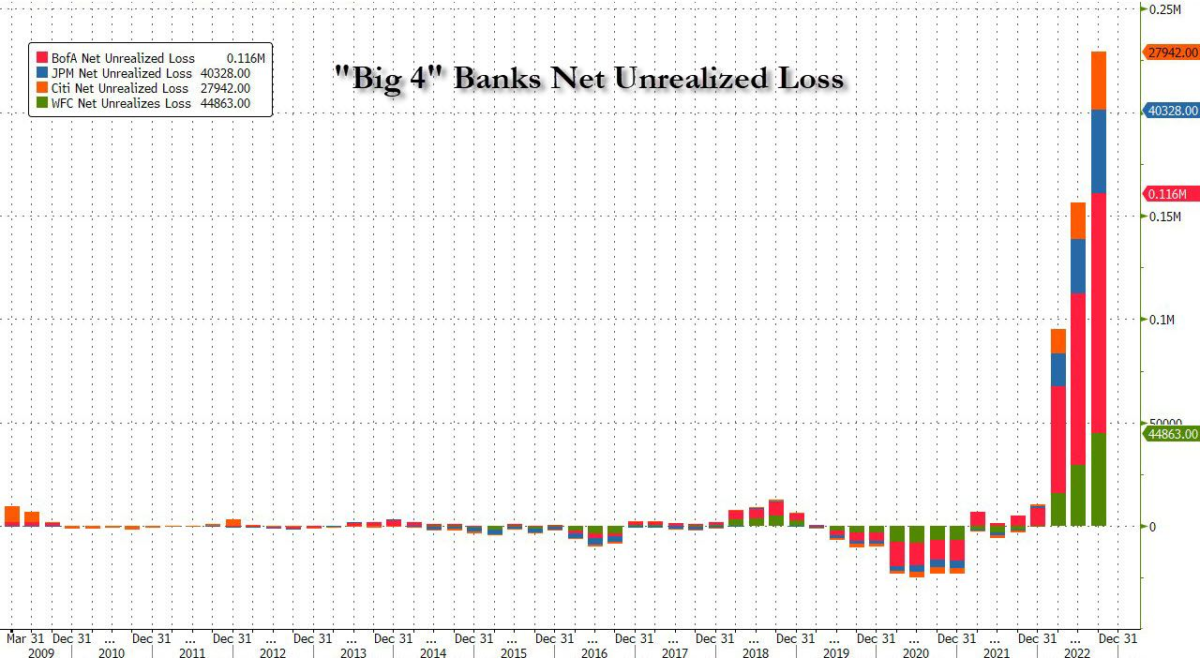

As these MBS cratered in value across the banking industry, the banks can keep them as “unrealized losses” and don’t have to “mark to market” at current low prices in their accounting. The FDIC reported last month that ‘unrealized losses’ at U.S. banks for bond (debt) holdings totaled $620 billion at the end of 2022. (Speech here.) This appears to be the huge iceberg that’s inspired a new industry bailout ‘facility’ over the weekend.

International Regulations? No ‘Basel III’ For SVB

SVB was involved with home mortgages and ‘wealth management’ as well as startup investments and venture capital, so it will take some time to understand the scope of the collapse’s effect. The bank was exempt from the U.S. version of ‘Basel III’ transparency regulations, which the Fed only applies to “large, internationally active” American banks. Although SVB had branches in: London, Stockholm, Tel Aviv, Bangalore, Frankfurt, Copenhagen, Beijing, Hong Kong, Shanghai, Shenzhen, and Frankfurt, it was permitted to fall short of those standards.

The Financial Times chuckled that “Silicon Valley Bank is a very American mess,” adding:

“The Fed adopted a rule under which only the very largest international banks were subject to the full Basel [Net Stable Funding Ratio – NSFR] requirements…. as we’re seeing now, the fact that a risk isn’t covered by a regulatory ratio doesn’t mean it doesn’t exist…. The fact that large domestic banks in the U.S. are apparently allowed to run such sizable funding mismatches… is likely to be a source of embarrassment to the U.S. authorities next time they visit the big Swiss tower.”

Financial Times, “Silicon Valley Bank is a very American mess.”

That brutalist Swiss tower is the Bank for International Settlements (BIS), the de facto ‘central bank of central banks’ created in 1930 (PDF) for channeling World War I German war reparations.

Photo by Taxiarchos228, Wikimedia Commons

Basel III, an international treaty-like framework painstakingly negotiated for years by the BIS Basel Committee, is supposed to prevent worldwide ‘contagion’ surprises by imposing better regulations, transparency, and codifying funding ratios to buffer against implosions like this. Its main principles were outlined around 2011, but implementation has taken far longer.

The New York Times added that the Trump Administration softened “Dodd-Frank” bank regulations that might also have prevented this collapse by requiring more reserves and disclosures. 17 Democratic Senators and 33 House Members also backed the 2018 law. Just three years ago critics warned the dismantling of Dodd-Frank would leave “the economy vulnerable to grotesque financial concentration, excessive risk and a repeat of the 2008 collapse.”

Largest collapse since 2007-2009 Great Financial Crisis

The bank’s collapse is the first time something at this scale in the U.S. economy has happened since the ‘Great Financial Crisis’ of 2007-2009, when investment firms started collapsing as housing prices dropped, ‘underwater’ homes with debts greater than their value (negative ‘equity’) led to a foreclosure wave, which snowballed in a contagion that rapidly went global. Hundreds of banks shuttered.

During that crisis, officials with the Fed and U.S. Treasury Department scrambled to cut deals that would protect both depositors and the well-heeled owners of incredibly vast sums of mortgage debts (bonds, MBS, credit default swaps, collateralized debt obligations, and other obscure, often opaque contractual ‘instruments’) while largely ignoring the plight of underwater homeowners.

Congress, fearing a full-blown economic collapse, authorized a massive bailout. Memorably in 2008 U.S. Rep. Brad Sherman (D-CA32 now, then CA27) announced on the House floor that some members were threatened with “martial law” as fallout from the crisis. (Sherman’s criticism of the doom-and-gloom threats in 2008 eerily parallels similar doomsaying to encourage bailouts this weekend.)

The bailout authorized the Federal Reserve to effectively ‘print money‘ digitally through new ‘facilities’ or ‘vehicles’ which are easily overlooked interfaces between banks, other financial firms and the government. (The brand-new Bank Term Funding Program (BTFP) follows about the same idea.)

In order to support the secondary debt ‘market price’ of MBS and other bonds, representing many trillions of dollars in debt, these facilities created new money in the U.S. economic system, and ‘purchased’ the bonds from the struggling financial firms using that new digital money. (This is sometimes called Fed ‘open market operations’ or at a larger scale, ‘quantitative easing.’)

The idea was to restore ‘liquidity’ in the banks, where the payments due on any given day could be covered, regardless of how much debt is held “on the books.” Banks like SVB may have lots of cash, but if they run out of ‘liquidity’ as SVB did, they essentially grind to a halt and enter the failure mode of an FDIC takeover.

Extending new ‘credit’ lines that electronically funnel new money to commercial entities’ bank accounts is, generally speaking, how the Fed fixes liquidity crises. (Critics argue this lenient practice rewards ‘moral hazard’ by withholding economic punishment for misconduct, inspiring future crises.) The bank accounts of the banks themselves, which get this new money, are at the Federal Reserve banks.

In the midst of the last crisis, the ‘Federal Reserve balance sheet’ (the grand total of all those internal accounts and facilities) filled up with bonds that were nominally worth hundreds of billions of dollars. However since no one was interested in buying them they essentially had no ‘market price.’ The debt markets were nonfunctional, chaotic and ‘discontinuous.’ Derivatives, which are contracts that bet on the changing prices of other assets (for example commodities like oil, or the current market price of a type of debt) also became unstable and discontinuous. Some securities really had no calculable value, because the input numbers on the derivative contracts were themselves unavailable and unpriceable. (The entire derivatives market can sometimes be valued beyond trillions, into quadrillions of dollars, though they are usually set up to ‘offset’ and cancel each other out in various ways.)

After the collapse of Bear Stearns in March 2008, then Lehman Brothers and Merrill Lynch investment firms, and the Fed decided to expediently protect ‘re-insurance companies’ like AIG that essentially insure insurance companies. (The Trump Administration released AIG from strict federal oversight in 2017, just nine years after it received an $182 billion bailout.)

Firms like AIG were caught in a bad situation because they recklessly promised to make payments in the event that mortgages defaulted (credit default swaps – CDSs – were valued at $45 trillion during the crisis and collateralized debt obligations – CDOs – were also key). The scale of the defaults was enormous and the extremely wealthy investors who stood to lose everything for purchasing these now-worthless instruments were largely saved, defended and bailed out by the Fed, who purchased their “worthless paper” for arbitrarily high prices, via the digital machinery of the Fed ‘facilities’ crediting their bank accounts with newly materialized US Dollars.

While the U.S. economy’s corporate sectors and upper classes largely recovered from the great financial crisis, the burden of underwater mortgages and foreclosures fell most heavily on minorities, and big investors used cheap credit to buy up and liquidate large segments of still-viable service sector businesses like retail and traditional media. Inequality in American economy steadily increased after the crisis. Entire communities lost homes in this time — all their previous payments on the homes were made moot when foreclosed upon, and that ‘equity’ wafted away as easily as it had been created on the banks’ computers in the first place.

The Shadow Repo Market Bailout of Late 2009

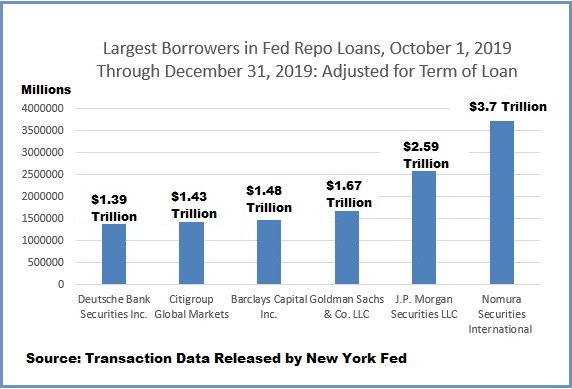

There was one more little-understood trillion-dollar-scale economic anomaly before Covid: the ‘repo markets’ (repurchase agreements) involve other facilities which the Fed uses to nudge ‘overnight’ daily interest rates on bank deposits. Around September-December 2019 there was a huge surge as several banks used the repo facilities to get hundreds of billions of dollars. The Fed largely blamed this mysterious activity on quarterly corporate tax payments causing some ripple in bank cash stability and other obscure factors, but there is probably more to the multi-trillion dollar story.

On Wall Street on Parade a series of reports showed how in the last quarter of 2019, a huge shadow multi-trillion dollar bailout of sorts through the money markets or repo markets unfolded – coverage indexed here.

The Martens found a huge Japanese investment bank called Nomura Securities International borrowed $3.7 trillion through the Fed repo system, JP Morgan Securities LLC borrowed $2.59 trillion, Goldman Sachs & Co. borrowed $1.67 trillion, Barclays Capital Inc. borrowed $1.48 trillion, Citigroup Global Markets borrowed $1.43 trillion, and Deutsche Bank Securities Inc. borrowed $1.39 trillion, all through repo market facilities during that mysterious last quarter of 2019. (Why foreign banks based in Germany and Japan deserved such massive aid from U.S. taxpayer-backed entities like the Fed is also unclear.)

Covid Economic Crisis Led to Low Interest Rates, Taxpayers Backstop Debt Markets through ‘Facilities’ Again

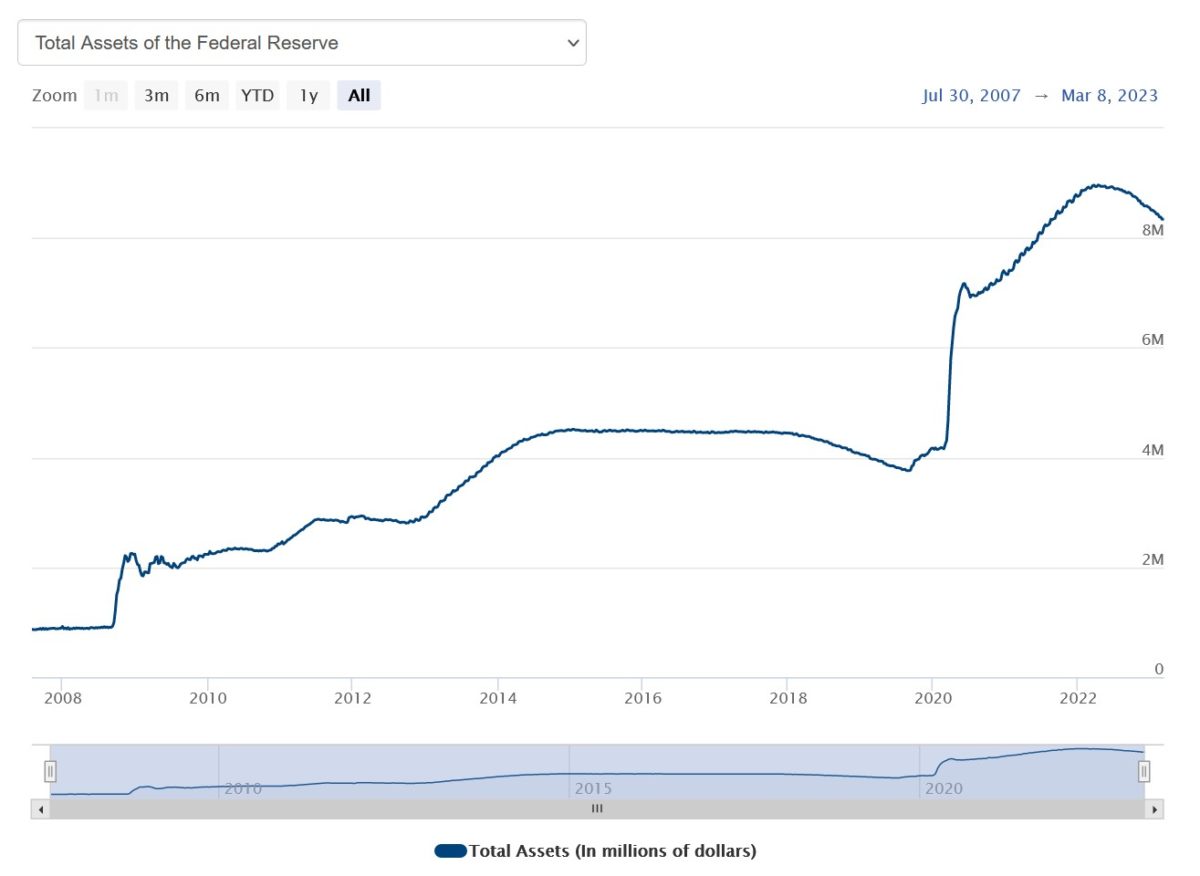

Fast-forward to early 2020 — the eerie echoes of the last crisis reverberated as the deepening panic of the Covid pandemic’s economic chaos intensified. The Fed once again used the digital economic power of its facilities to buy up securities and butter up prices on the secondary debt markets. The Fed trimmed its ‘balance sheet’ after the first financial crisis, but once again took these debt instruments aboard to address the crisis. (This strategy is largely described as ‘quantitative easing’ in mainstream media coverage.)

The Congressional Research Service reported (PDF), “The [Fed] balance sheet increased from $4.7 trillion on March 19, 2020, to $7 trillion on May 20, 2020, and $7.4 trillion at the end of 2020.” The Covid pandemic Fed facilities included the traditional ‘Discount window’ where banks pledge assets in exchange for U.S. Treasuries, ‘intraday credit,‘ the newly created Primary Market Corporate Credit Facility (PMCCF) which remained dormant and Secondary Market Corporate Credit Facility (SMCCF) which was lightly used, as well as: Term Asset-Backed Securities Loan Facility (TALF), Main Street Lending Program (MSLP), Municipal Liquidity Facility (MLF), the Money Market Mutual Fund Liquidity Facility (MMLF), the Commercial Paper Funding Facility (CPFF), the Primary Dealer Credit Facility (PDCF) and Paycheck Protection Program Lending Facility (PPPLF).

Even the most obscure old tools of financial state power like the U.S. Exchange Stabilization Fund (ESF) were put into play. It is an “important element of US foreign policy and economic policy,” a Treasury Department account established by the Gold Reserve Act of 1934 and made permanent under Bretton Woods in 1945, and has been used by the White House since then to manage gold and currency crises. (ESF was also used to backstop some money market funds in the 2008 crisis.) The July 31, 2020 ESF “Statement of Financial Position” shows a table (PDF) of ESF’s component assets and liabilities on that day, which reveals it funding several of the facilities listed above. (More on ESF & Covid-19 from the Congressional Research Service – PDF.)

In all, trillions of dollars, euros and other currencies got created through similar central bank facilities in attempts to stabilize market conditions during the Covid financial crisis. These trillions were created by both private lenders and central bank facilities to nudge debt markets that are largely ignored in mainstream economic coverage. U.S. stocks largely recovered after a few months, then roared higher. Other “Covid bailout” policies, far away from Wall Street, like small sums sent out en masse to Americans later, took a great deal of blame for the rising prices — generally described today as “inflation” in the mainstream media.

The upper crust of the economy, the wealthy 1%, somehow absorbed a great deal of the global economy’s new trillions. An OxFam report released in January said, “The richest 1 percent grabbed nearly two-thirds of all new wealth worth $42 trillion created since 2020, almost twice as much money as the bottom 99 percent of the world’s population.” (Full report PDF here.)

In July 2021, the Fed announced two new “standing repurchase agreement facilities” for the ‘repo market,’ the “domestic standing repo facility” (SRF) and a “repo facility for foreign and international monetary authorities” (FIMA repo facility) which would “serve as backstops in money markets” to “smooth market functioning.” With merely a half-trillion dollar line of electronically creatable money, the Fed would “conduct daily overnight repo operations against Treasury securities, agency debt securities, and agency mortgage-backed securities.” The counterparties would be the Fed’s “primary dealers” which are the banks and securities broker-dealers who traditionally get the first bite at these newly printed instruments.

Meanwhile in Silicon Valley, the low interest rates and “cheap money” available spurred both a cryptocurrency bubble and a wave of acquisitions, mergers, and venture capital finance rounds (“Series A” and the like). The Silicon Valley Bank was at the heart of this churn until this week.

Housing prices and the creation of new mortgage-backed securities soared while banks electronically generated cash to finance the home purchases, but this high-flying market priced out the underclass and left many thousands of residents behind, spurring an ongoing crisis of homelessness. Note in ‘fractional reserve banking,’ when banks issue mortgages, they privately create ‘new’ electronic money at the same time, often called ‘commercial bank money’ and part of ‘broad money.’ In 2014 researchers proved loans trigger the creation of new money independently. The purchases of homes are mostly not conducted by drawing on existing ‘reserves.’ The bundling of these IOUs & future payment streams represents the creation of Mortgage Backed Securities, to be resold to other investors or the Fed.

Some wags online say last year’s credit conditions are what drove venture capitalists to ever-accelerating heights of misanthropic snarling online rage at both the local underclass in the Bay Area, and society in general. Credit conditions tightening in late 2022 put a lot more pressure on wealthy tech investors like Elon Musk, who was forced to finance his purchase of Twitter on far more expensive terms than he might have expected just months earlier. (Indeed he has continued to grumble about higher interest rates while, like a giant credit card, his massive payments for Twitter debt come due, causing him to liquidate Tesla stock, repeatedly knocking its price down.)

Debt Delinquencies Increasing as American Public Squeezed by Higher Prices, Corporate Profits

While the Fed has largely reported that Americans are paying their debts — aided greatly by a few rounds of direct stimulus payments, extended food stamps, health care, child tax credits and similar programs — this status quo has eroded after months of high prices largely dubbed ‘inflation’ in the media. The Biden era has just brought the end of extended food stamps, and the child tax credit could not be saved, even though the programs greatly but briefly reduced child poverty and food insecurity.

The vast American automotive market is also in trouble. Americans are now falling behind in car payments in greater numbers. Used car prices spiked during the pandemic, and bloated new car and truck models were financed at ever higher prices and long terms with low interest rates. (Auto companies looking to create payment streams through collateralized auto loans, actually function much like banks — earlier this led to General Motors’ own GMAC expanding into other forms of credit before the last crisis – PDF.) If the repo men and women start collecting large numbers of vehicles (perhaps aided by new remote shutoff features!) then the repossessed cars will compete with new cars, potentially causing another fall in prices and ‘severely underwater’ cars that are no longer worth putting payments on — a spiral similar to the 2007-2008 housing crisis.

Other balances like credit cards and similar revolving debts are becoming more delinquent. Credit card interest rates are now markedly higher than six months ago. A new cottage industry of installment payments for other purchases like food and late rent payments (called ‘Buy Now Pay Later’ or BNPL) indicates that the American consumer is under pressure and can’t simply make payments in full. (It seems probable at least some of these new consumer installment payment startup vendors are themselves entangled in the collapsed SVB bank.)

For people closing the ledger on American life and entering the afterlife, even death is little escape from the healthcare bill collectors. Via “estate recovery programs,” health care programs like Medicaid are being aimed at the estates of the deceased middle and lower classes, who often have little inheritance to their offspring besides real estate. This creates pressure for divorces to protect assets, and eugenics-style cutoffs of senior health services.

Bank Turbulence Amid High Interest Rates, Links to Corruption & Collapsed Cryptocurrency Cons

Another long-troubled bank, Credit Suisse, hit an all-time low on Friday, after a last-minute call from the Securities and Exchange Commission delayed its annual report. Also the Organized Crime and Corruption Reporting Project (OCCRP) revealed “the head of a Russian criminal gang allegedly close to the Russian president” received services from UBS and Credit Suisse via a Cypriot trust called PTC. Russian-Israeli citizen Gavril Yushvaev, the beneficial owner of PTC, was a known founder of Baumanskaya, “one of Russia’s three most powerful organized crime groups” and one of the top 100 wealthiest individals in Russia, among other facts about criminal finance which were largely known when “UBS and Credit Suisse accepted Yushvaev’s trust as a client.”

The Martens warn that JP Morgan Chase continues to be heavily exposed to the troubles of hedge funds. Leading up to the collapse of Silvergate, they’ve also called attention to the mainstream finance players who became entangled with the once mighty cryptocurrency empire of Sam-Bankman Fried and his now-collapsed firms FTX and Alameda Research, including indicted FTX alleged fraud “masterminds” who used 140-year old heavy hitter firm Sullivan & Cromwell for “more than 20 legal engagements” before the spectacular collapse.

In a blunt letter on January 30, U.S. Senators Elizabeth Warren (D-MA), John Kennedy (R-LA) and Roger Marshall (R-KS) highlighted that Silvergate had “turned to the Federal Home Loan Bank (FHLB) of San Francisco for an injection of cash large enough to ‘stave off a further run on deposits’,” by securing $4.3 billion in cash. Thus they wrote, “Silvergate has further introduced crypto market risk into the traditional banking system.” Furthermore, they warned if Silvergate failed FHLB would be ahead of FDIC and “all other creditors” which thus could stick FDIC and “the American taxpayer holding the bag.” Earlier this week, less than two months after the letter, Silvergate collapsed much as the senators expected. Investment firms Citadel Securities and BlackRock benefited from the pre-collapse FHLB cash infusion — they had stakes of 5.5% and 7% recently reported.

The Martens also point out that Jamie Dimon is avoiding a deposition to the Attorney General’s office of the U.S. Virgin Islands for how JPMorgan Chase “allegedly sat on a pile of evidence that Jeffrey Epstein was running a child sex trafficking ring as it continued to keep him as a client,” including financial services like “large sums of cash and wire transfers to pay off victims.” That unfolding case is USVI v. JPMorgan Chase Bank N.A. (22-cv-10904) in U.S. District Court, Southern District of New York.

Many including the Martens are calling attention to a key economic indicator, the 6-month U.S. Treasury Bill, which has reached a yield above 5%, a condition last reached 2007, shortly before the Great Financial Crisis fully took off. (During the dot-com crisis in late 2000, it also shot above 6%.) Earlier this week, on March 7, the yield briefly spiked to 5.354%.

Commercial real estate, suffering from the Covid-era retreat from office workplaces, may face a massive wave of mortgage defaults this year, a “financial tsunami” as even huge companies like Brookfield Properties let their buildings default.

Meanwhile, the U.S. House is heavily influenced by fringe conservatives that openly flout the commitment to “raising the debt ceiling” and often tease holding hostage the “full faith and credit” of the U.S. government, which until now, has safely kept paying Treasuries when they’re due. This bloc issued new debt ceiling demands on Friday. However the fractured House GOP has been unable to agree on a national budget vision of its own, constrained between sky-high military spending, Republican low-tax commitments, Social Security, Medicare and popular social programs.

It is fair to say, even if David Sacks and Larry Summers prevail on the ruling financial powers to bail out Silicon Valley Bank depositors (or more likely a rescue from Bank of America, Wells Fargo or Morgan Stanley saves their friends’ bacon), the troubles of the highly deregulated capitalist economy and its billions of debt-laden inhabitants will be far from over.

Please consider a tax-deductible donation to help sustain our horizontally-organized, non-profit media organization:

Follow us on X (aka Twitter), Facebook, YouTube, Vimeo, Instagram, Mastodon, Threads, BlueSky and Patreon.